Oil Fireworks Unsettle Global Markets Ahead Of Payrolls Report

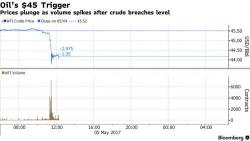

With all eyes on crude, following last night's mini flash crash which sent WTI lower by 3% from just above $45 to under $43 in under 10 minutes, equity markets, generally quiet overnight, have taken on a secondary importance ahead of today's key risk event, the April payrolls report (full preview here). In global equities, Asian and European stocks are lower, while S&P futures are little changed.