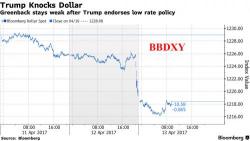

Dollar, Yields, Futures Under Pressure Following Weak US Data; Europe Closed

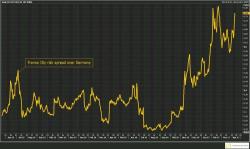

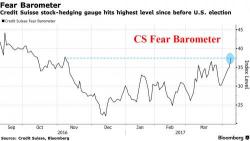

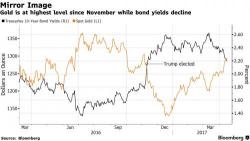

Following Sunday night's resumption of trade after a three-day weekend, which saw sharp moves lower in US yields, the dollar and the USDJPY after Friday's disappointing CPI and retail sales data and the weekend's North Korea jitters, the mood has stabilized in light trading with Asian stocks advancing, Europe mostly closed for Easter Monday and S&P futures fractionally lower at 2,325 in early New York trading.