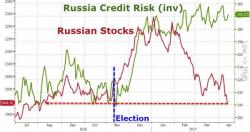

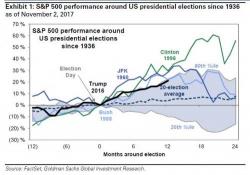

"The S&P Is Up 21% Since Trump's Election" And Other Market Anniversary Observations

November 8 will mark the one year anniversary of one of the biggest political shocks in US history: the election of Donald Trump. Since that improbable victory, which so many experts had said would lead to a market crash, the S&P 500 has soared by 21% according to Goldman which calculates that the Trump rally so far ranks as the fourth-best 12-month gain following a presidential election since 1936, trailing only Bill Clinton (1996, 32%), John F. Kennedy (1960, 29%), and George H.W. Bush (1988, 23%).