Russia Unexpectedly Cuts Interest Rates For The First Time In Seven Months

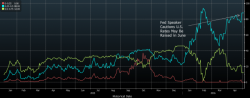

The Russian Central Bank surprised markets when it unexpectedly cut interest rates by 25 bps to 9.75% (30 economists expected no change, 8 predicted a 25 bps cut), its first rate cut in four meetings or 7 months, as inflation, which has dropped from a peak of 17% to just 4.6% last month, appears to be under control, while growth is returning to the oil-dominated economy driven by the steady price of oil.