US Futures Flat Ahead Of December Payrolls; Dollar Rebounds

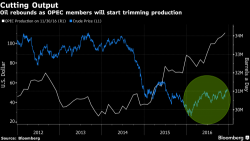

European shares fell modestly, Asian equities declined for the first day in three, and US equity futures were unchanged before the December U.S. nonfarm payrolls report. China’s offshore yuan fell the most in a year to pare a record weekly rally, while Mexico’s peso climbed after the central bank sold dollars. Oil was trading lower in early trading.