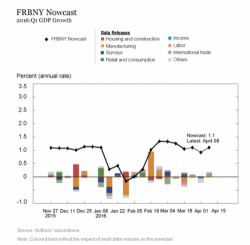

Fed vs. Fed: New York Fed To Issue Its Own GDP Nowcast; Atlanta Fed Too Pessimistic?

Submitted by Mike "Mish" Shedlock

Fed vs. Fed: New York Fed To Issue Its Own GDP Nowcast; Atlanta Fed Too Pessimistic?

It’s Fed vs. Fed in the Nowcasting business. The New York Fed has decided to issue a FRBNY Nowcast, clearly in competition with the Atlanta Fed GDPNow forecast.

The Atlanta Fed has the name GDPNow trademarked.

The Atlanta Fed provides its updates following major economic reports. In contrast, the New York Fed will deliver its version every Friday starting April 15.