Published

3 seconds ago

on

May 22, 2024

| 27 views

-->

By

Julia Wendling

The following content is sponsored by The Hinrich Foundation

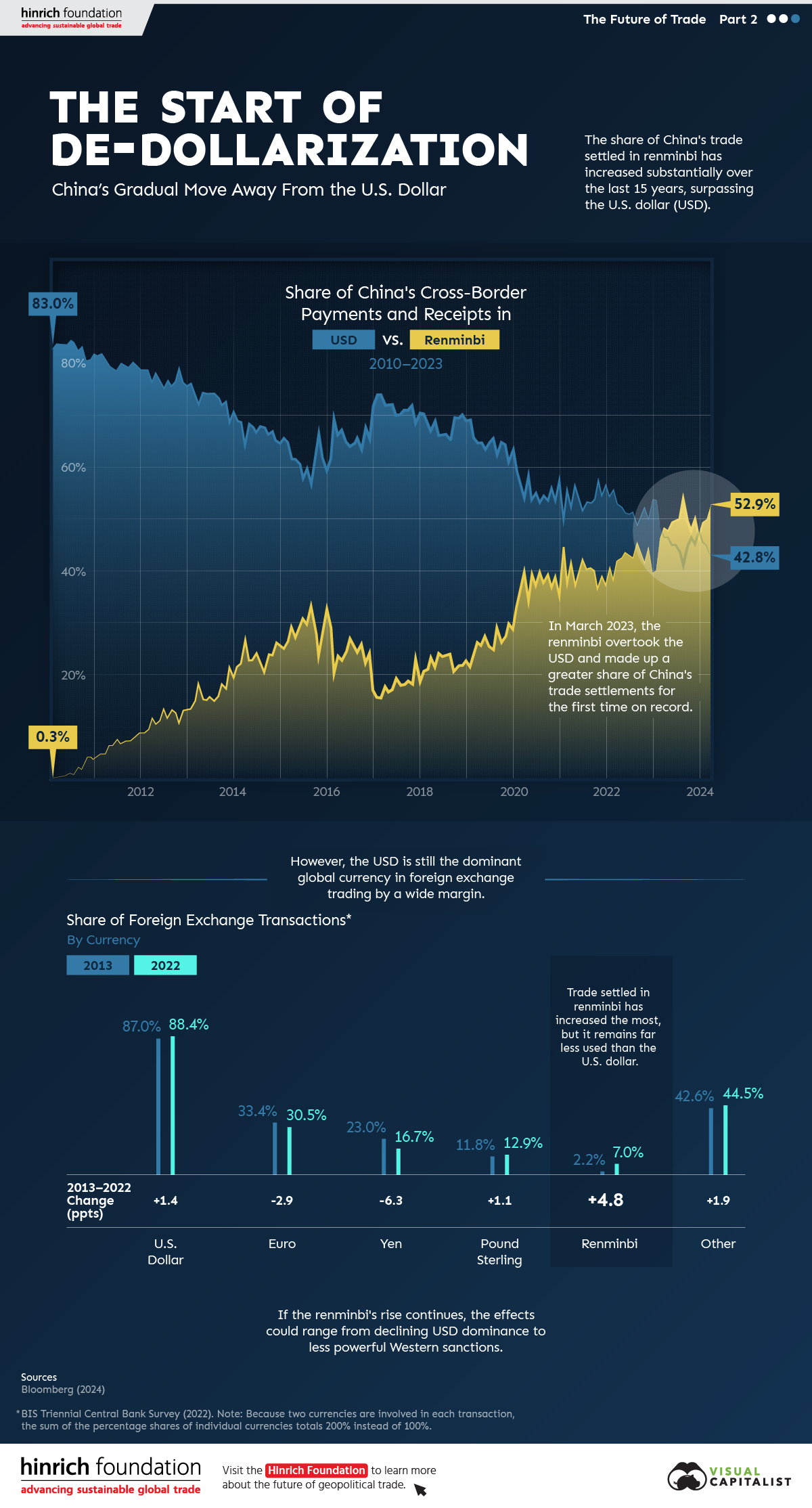

The Start of De-Dollarization: China’s Move Away from the USD

Since 2010, the majority of China’s cross-border payments, like those of many countries, have been settled in U.S. dollars (USD). As of the first quarter of 2023, that’s no longer the case.

This graphic from the Hinrich Foundation, the second in a three-part series covering the future of trade, provides visual context to the growing use of the Chinese renminbi (RMB) in payments both domestically and globally.

The De-Dollarization of China’s Cross-Border Transactions

This analysis uses Bloomberg data on the share of China’s payments and receipts in RMB, USD, and other currencies from 2010 to 2024.

In the first few months of 2010, settlements in local currency accounted for less than 1.0% of China’s cross-border payments, compared to approximately 83.0% in USD.

China has since closed that gap. In March 2023, the share of the RMB in China’s settlements surpassed the USD for the first time.

| Date | Renminbi | U.S. Dollar | Other |

|---|---|---|---|

| March 2010 | 0.3% | 84.3% | 15.4% |

| March 2011 | 4.8% | 81.3% | 13.9% |

| March 2012 | 11.5% | 77.1% | 11.5% |

| March 2013 | 18.1% | 72.7% | 9.2% |

| March 2014 | 26.6% | 64.8% | 8.6% |

| March 2015 | 29.0% | 61.9% | 9.0% |

| March 2016 | 23.6% | 66.7% | 9.7% |

| March 2017 | 17.6% | 72.5% | 9.9% |

| March 2018 | 23.2% | 67.4% | 9.4% |

| March 2019 | 26.2% | 65.1% | 8.7% |

| March 2020 | 39.3% | 54.4% | 6.3% |

| March 2021 | 41.7% | 52.6% | 5.6% |

| March 2022 | 42.1% | 53.3% | 4.7% |

| March 2023 | 48.4% | 46.7% | 4.9% |

| March 2024 | 52.9% | 42.8% | 4.3% |

Source: Bloomberg (2024)

Since then, the de-dollarization in Chinese international settlements has continued.

As of March 2024, over half (52.9%) of Chinese payments were settled in RMB while 42.8% were settled in USD. This is double the share from five years previous. According to Goldman Sachs, foreigners’ increased willingness to trade assets denominated in RMB significantly contributed to de-dollarization in favor of China’s currency. Also, early last year, Brazil and Argentina announced that they would begin allowing trade settlements in RMB.

Most Popular Currencies in Foreign Exchange (FX) Transactions

Globally, analysis from the Bank for International Settlements reveals that, in 2022, the USD remained the most-used currency for FX settlements. The euro and the Japanese yen came in second and third, respectively.

| Currency | 2013 | 2022 | Change (pp) |

|---|---|---|---|

| U.S. Dollar | 87.0% | 88.5% | +1.5 |

| Euro | 33.4% | 30.5% | -2.9 |

| Yen | 23.0% | 16.7% | -6.3 |

| Pound Sterling | 11.8% | 12.9% | +1.1 |

| Renminbi | 2.2% | 7.0% | +4.8 |

| Other | 42.6% | 44.4% | +1.8 |

| Total | 200.0% | 200.0% |

Source: BIS Triennial Central Bank Survey (2022). Because two currencies are involved in each transaction, the sum of the percentage shares of individual currencies totals 200% instead of 100%.

The Chinese renminbi, though accounting for a relatively small share of FX transactions, gained the most ground over the last decade. Meanwhile, the euro and the yen saw decreases in use.

The Future of De-Dollarization

If the RMB’s global rise continues, the stranglehold of the USD on international trade could diminish over time.

The impacts of declining dollar dominance are complex and uncertain, but they could range from the underperformance of U.S. financial assets to diminished power of Western sanctions.

However, though the prevalence of RMB in international payments could rise, a complete de-dollarization of the world economy in the near- or medium-term is unlikely. China’s strict capital controls that limit the availability of RMB outside the country, and the nation’s sputtering economic growth, are key reasons contributing to this.

The third piece in this series will explore Russia’s shifting trading patterns following its invasion of Ukraine.

Visit the Hinrich Foundation to learn more about the future of geopolitical trade

Please enable JavaScript in your browser to complete this form.Enjoying the data visualization above? *Subscribe

Related Topics: #china #united states #USD #fx #trade #international trade #foreign exchange #Hinrich Foundation #de-dollarization #cross-border payments #rmb

Click for Comments

var disqus_shortname = "visualcapitalist.disqus.com";

var disqus_title = "The Start of De-Dollarization: China's Gradual Move Away from the USD";

var disqus_url = "https://www.visualcapitalist.com/sp/hf02-start-of-de-dollarization-chinas-gradual-move-away-from-the-usd/";

var disqus_identifier = "visualcapitalist.disqus.com-166971";

You may also like

-

Politics6 days ago

Which Countries Have the Most Economic Influence in Southeast Asia?

One country dominates this survey of who has the most economic influence in the region.

-

Public Opinion1 week ago

Charted: How Democrats and Republicans View Government Agencies

Predictably, results diverge when both Democrats and Republicans are asked to rate key government agencies in the United States.

-

War2 weeks ago

Visualized: Aircraft Carriers by Country

The U.S. controls 40% of global aircraft carrier fleet.

-

Public Opinion2 weeks ago

Charted: How Americans Feel About Federal Government Agencies

Fourteen of 16 federal government agencies garnered more favorable responses than unfavorable ones. But what were the outliers?

-

United States3 weeks ago

Charted: What Southeast Asia Thinks About China & the U.S.

A significant share of respondents from an ASEAN-focused survey are not happy about rising American and Chinese influence in the region.

-

Politics3 weeks ago

Charted: Trust in Government Institutions by G7 Countries

How much do you trust the government and its various institutions? We look at data for G7 countries for the time period of 2006-2023.

Subscribe

Please enable JavaScript in your browser to complete this form.Join the 375,000+ subscribers who receive our daily email *Sign Up

The post The Start of De-Dollarization: China’s Gradual Move Away from the USD appeared first on Visual Capitalist.