Quad Witching Arrives: Futures Steady, Stoxx 50 Erase 2016 Loss As Dollar Steadies

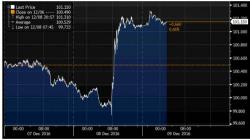

Quad-witching Friday has arrived, which means that alongside thin, pre-holiday liquidity and a jumpy market, we expect to see sharp, volatile moves for the rest of the day, the first of which was just noted in Europe, where stocks moved from session lows to highs in the span of minutes, in the process sending the Euro Stoxx 50 index 0.8% higher and turning it positive on the year as it reached its highest level since December 2015. The broader Stoxx 600 remains still down 1.8% on the year.