European Stocks Soar, US Futures, Euro Jump After Failed Italian Referendum

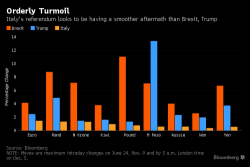

Blink, and you missed the "sell off" from Italy's failed referendum vote.

Blink, and you missed the "sell off" from Italy's failed referendum vote.

Did Jeff Gundlach do it again? Shortly after the DoubleLine manager told Reuters yesterday afternoon that the Trump rally is ending, that "stocks have peaked" and that it is "too late to buy the Trump trade", US stocks tumbled to session lows, and have continued to drop overnight, with S&P futures down 0.3%, alongside sliding Asian and European markets; oil and the dollar are also down with the only asset class catching a bid are 10Y TSYs, whose yields are lower at 2.43% after reaching an 18 month high of 2.492% overnight ahead of today's nonfarm payrolls report.

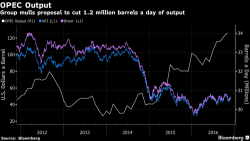

European, Asian stocks rise as do S&P futures as OPEC ministers gathering in Vienna appeared to be set to announce a deal to cut oil production and prop up global prices. Oil has surged over 7% as a result, also pushing US TSY yields and the dollar higher.

With all eyes on Vienna, where optimism OPEC ministers will salvage a deal to cut production, oil has soared by over 6% reverberating through the financial markets, spurring oil’s biggest gain in two weeks and sending stocks of energy producers and currencies of commodity-exporting nations higher.

European stocks were little changed and oil fell as investors assessed declining prospects for an OPEC deal and risks from Italy’s referendum. Asian stocks declined, while S&P futures pointed to a fractionally higher open, erasing 3 points from yesterday's drop.

Trader attention today - and tomorrow - will be focused on oil which retreated back under $47 as OPEC members failed to bridge differences on production cuts, while a rally in metals ran out of steam. The rand plunged after President Jacob Zuma survived a leadership threat.

European shares dipped and U.S. equity-index futures (-0.3%) pointed to a lower open as traders questioned the stability of the Italian banking sector ahead of next weekend's referendum as well as the longevity of the Trumpflation rally, pressuring the dollar, sending the USDJPY sliding as low as 111.355 overnight, before rebounding over 112. That was the dollar's biggest fall against its Japanese rival since October 7 and against a basket of top world currencies it was the greenback's worst day since November.