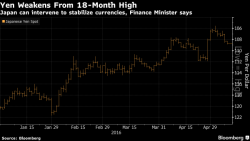

Futures Halt Selloff, Levitate Higher On Another USDJPY Spike; Oil Rises

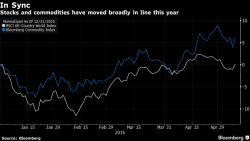

If yesterday's selloff had a specific catalyst, namely some of the worst consumer retail earnings seen in years, it merely undid the Tuesday rally which levitated global risk with no fundamental driver, aside for a 200 pip spike in the USDJPY. Some central bankers may even say it was a "magical" levitation.