Futures Rebound Off Lows Following Chinese Intervention; Oil Dips Ahead Of Fed, BOJ

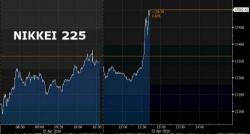

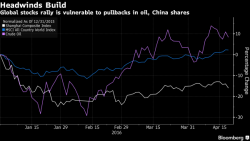

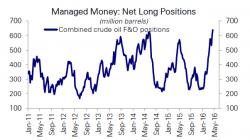

Ahead of two key central banks events this week, the Fed announcement on Wednesday - in which Yellen is expected to do nothing and most likely will continue the dovish relent first seen a month ago - and then the BOJ on Thursday (which also mark the anniversary of the second longest and most artificial bull market in history) where Kuroda is increasingly expected to shock with something even more ridiculous, global shares have fallen modestly around the world as oil declined on signs a global surplus of crude is likely to persist.