Currency War Resumes - China Devalues Yuan To 5-Year Lows

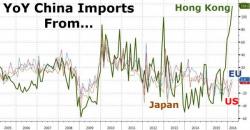

After a brief hiatus from the ongoing currency wars, China fired another salvo at The Fed tonight by devaluing the Yuan fix to 6.5693 - its weakest against the USD since March 2011. After eight days higher in a row for The USD Index, it seems PBOC has turned its currency liberalization plan off, stabilizing the broad Renminbi basket (which has been steadily devalued) and turning its attention to devaluing against the USD.