With China Facing Currency, Liquidity Crises, Ex-PBOC Official Urges Use Of "Nuclear Option"

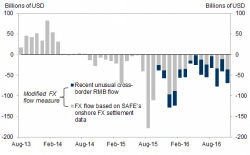

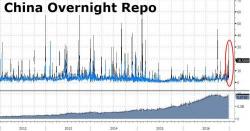

With the PBOC fighting tooth and nail to slow outbound capital flight, which according to Goldman has reached $1.1 trillion since August 2015, and which these days mostly means keeping the Yuan from depreciating to new all time lows below 7 Yuan to the Dollar, the Chinese central bank may have its work cut out for it in the immediate future. The reason is that, as Bloomberg reminds us, the first day of 2017 is when an annual $50,000 quota to convert the yuan into foreign exchange resets, stoking concern there will be a rush to sell the local currency.