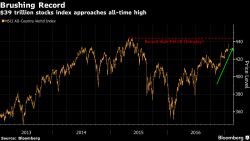

Dollar Rebound Continues, Europe Stocks Pressured By Banks As Much Of Asia Goes On Holiday

US equity futures are unchanged, trading near record highs after digesting a spate of earnings results on Thursday. The dollar pared its weekly loss as the yen and pound slid, while gold headed for its longest slump in three months. European equities fell and markets in Asia were mixed, while markets in China, South Korea, Taiwan and Vietnam were closed Friday for the start of Lunar New Year. Hong Kong, Malaysia and Singapore had shortened sessions.