"When Everyone Is Sure They Know What's Going To Happen, They're Wrong"

Via Miller's Market Musings,

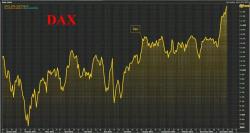

What A Long Strange Trip It's Been

Sometimes the light's all shinin' on me,Other times I can barely seeLately it occurs to me what a long, strange trip it's been

-The Grateful Dead, 1970, by Jerome Garcia, Philip Lesh, Robert Hunter and Robert Weir