One Trader's Advice: "Listen To Yellen, Ignore Fundamentals"

Laugh or cry, the choice is yours.

Here is trader Keith Bliss explaining why one should listen to the "stock whisperer", and ignore fundamentals.

He maybe on to something...

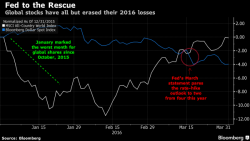

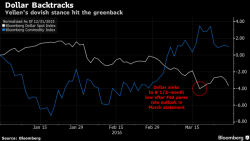

Since macro doesn't matter...

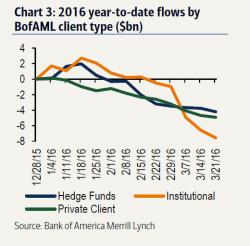

And neither do earnings...

According to Bliss, trading is simple as 1, 2, 3: