Utilities Winning By Not Losing

Via Dana Lyons' Tumblr,

While the broad stock market has been getting hammered, the utility sector hit a 52-week high this week – and achieved a significant relative breakout.

Via Dana Lyons' Tumblr,

While the broad stock market has been getting hammered, the utility sector hit a 52-week high this week – and achieved a significant relative breakout.

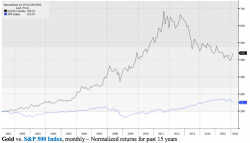

Almost every other day I read an article telling me that owning Gold is dumb or that Gold is doomed as an investment.

These articles would be useful or insightful if they weren’t based on “analysis” that is either misleading or downright wrong.

To whit…

Gold has absolutely CRUSHED stocks since 2000. During this period we’ve had two of the biggest stock market bubbles in history. Yet Gold’s performance has made stocks’ performance look like a flat-line.

H/T Bill King.

With China celebrating the Lunar New Year and offline until next weekend, and with the US in the usual post-payrolls macro newsflow lull, the markets will have more than enough time to stew in the latest source of contagion fears, namely Europe, the same Europe which until recently was fixed but is broken all over again. The highlight of the week will be Janet Yellen's semi-annual testimony to Congress where she is expected to confirm she is trapped: either push the market even lower by sounding hawkish, or admit the US is on the verge of a recession and admit policy error.

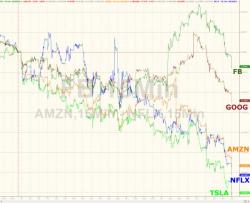

FANG stocks are collapsing in the pre-market as faith in the "growth at any cost" meme crashing on the shores of reality once again. Now down over 16% from their post-Fed-rate-hike highs, the stocks you should never sell are being sold in size as large crowds and small doors press NFLX and AMZN (and TSLA for good measure) down over 30% year-to-date. Even Mark Cuban is hedging...

It's carnage in the pre-open...

"For those of following my stock moves, I just bought puts against my entire Netflix position," Cuban posted on the site.

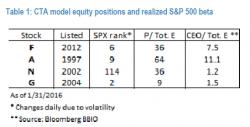

Just over two weeks ago, JPM's Marko Kolanovic, whose unprecedented ability to predict short-term market moves is starting to seem a little bizarre, warned that the next "significant risk for the S&P500" was the bursting of the "macro momentum bubble." Specifically, he said that there is an emerging negative feedback loop that is "becoming a significant risk for the S&P 500" adding that "as some assets are near the top and others near the bottom of their historical ranges, we are obviously not experiencing an asset bubble of all risky assets, but rather a bubble in relative