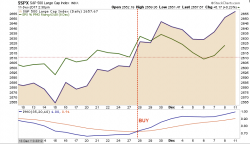

Global Stocks Roar To Record Highs As Tax Reform Is "Priced In" All Over Again

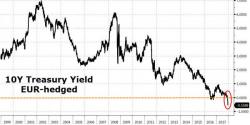

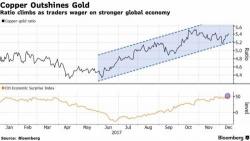

Global stocks and US equity futures roared upward to new record highs to start the second-to-last week of the year, boosted by optimism over a Republican agreement on the shape of U.S. tax cuts aimed at lifting growth; incidentally this is the 6th consecutive day that the "tax bill" has been priced in by the market, and according to cynics, 6th consecutive week and/or 6th month. Meanwhile, the dollar dropped and Treasuries headed lower.