Albert Edwards On The Selloff: "Comparisons With October 1987 Are Entirely Justified"

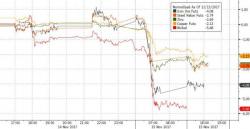

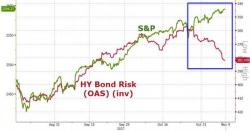

Last week, when equities were still blissfully hitting daily record highs, we showed the one "chart that everyone is talking about", or if they weren't they soon would be: the sharp, sudden disconnect between the junk bond and stock market ...

... a disconnect which - as we showed at the time - was last observed in mid-August 2015, just days before the infamous ETFlash crash. Fast forward to day, with stocks suddenly hitting air pockets around the globe and rapidly catching down to junk yields...