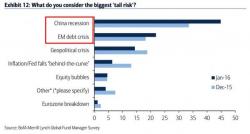

What The Smart Money Is Most Worried About: This Is The Biggest "Tail Risk" Keeping Traders Up At Night

When BofA's Michael Hartnett releases his monthly Fund Managers' Survey, the one chart we always head straight to is the one showing what the "smart money" investors, aka those polled clients who make up the survey (and the same ones who we reported earlier have been selling this bear market rally for the past seven straight weeks) are most worried about, or as they put it: what are the biggest "tail risks."

A brief walk down memory lane.