Stocks Stumble After Best Gains Since 2014's Bullard Bounce

The week explained...

http://www.youtube.com/watch?v=FsqJFIJ5lLs

Stocks extend gains this week - now the best 2-weeks since Bullard's Oct 2014 lows... BULLARD 2 - 0 REALITY

But ended on a weak note...

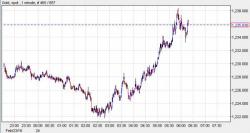

Futures give us a glimpse of the sudden buying panic into Europe's Open/China's close, selling at US Open on the "good" news... Weak close...

Even though Trannies and Small Caps gained on the day (more squeezes)...