These Were The Biggest Market Shocks In 2017... And What 2018 Has In Store

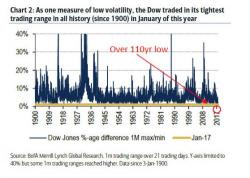

With 2017 almost entirely in the rearview mirror, the most memorable - and we clearly use the term loosely - and certainly historic feature of the past year was the complete collapse in volatility. In fact, as Bank of America noted last week, by one measure the Dow traded in its tightest trading range in all history in 2017.