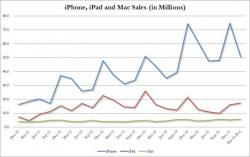

Why All Eyes Will Be On Apple's Earnings Report After The Close

Shortly after the close today, Apple will report its much watched earnings which will be closely watched for several reasons. The biggest one is that since Q1 2014 AAPL has contributed 25% of the S&P’s 4.2% growth rate (excluding the EPS benefit of the company's massive buyback program). Furthermore, roughly 40% of the nearly 9% jump in Tech margins since 2009 is attributable to Apple alone.

However, that was all in the past: this quarter Apple is actually forecast to subtract 0.7% from the S&P's bottom line.