Why Stocks Rebounded Overnight: Goldman Expects BOJ To Double Its Equity Purchases As Soon As Next Week

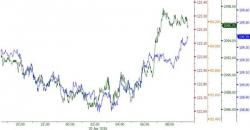

With oil - until recently the key signal for the S&P - down substantially overnight, many were scratching their heads why US equity futures not only rebounded from overnight lows but proceeded to wipe out all overnight losses and are currently trading in the green. The reason: another overnight ramp in the USDJPY which is the default fallback signal for stocks whenever oil isn't going higher.

But what precipirated the bounce in USDJPY?