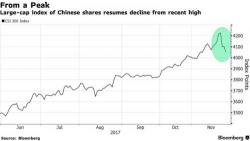

China Regulators Seek To Calm Mania For HK Stocks As Plunge Protectors Make An Appearance

The Chinese authorities’ efforts to contain leverage and reduce risk across the nation’s financial system took another step forward overnight with the ban on approvals for mutual funds that plan to allocate more than 80% of their portfolios to Hong Kong stocks. This looks like a response to surging capital flows into the territory from the mainland and the equity market euphoria in Asia, which saw the Hang Seng index cross the 30,000 mark last Wednesday for the first time in 10 years.