Global Stocks Levitate Despite Ongoing Oil Weakness; China Stocks Jump After Easing Margin Debt

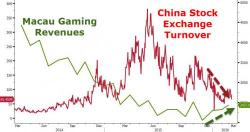

The sarcastic highlight of the overnight session was the Chinese stock market, where just one month after injecting a record amount of new loans into the financial system, the PBOC lamented the danger posed by China's tremendous debt load: "Lending as a share of GDP, especially corporate lending as a share of GDP, is too high" People’s Bank of China Governor Zhou Xiaochuan told China Development Forum yesterday.