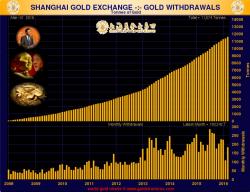

China Gold Yuan Trading To Boost Power In Gold and FX Markets – End Manipulation?

China Gold Yuan Trading To Boost Power In Gold and FX Markets – End Manipulation?

China launched yuan denominated gold bullion trading today in a move that will further boost its power in the global gold and fx markets. Critics of the existing pricing mechanisms hope that it will lead to increased transparency and may end price manipulation.