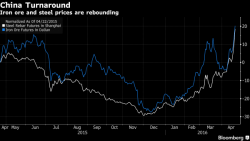

Futures, Crude Unchanged Ahead Of Draghi As Parabolic Move In Steel, Iron Ore Continues

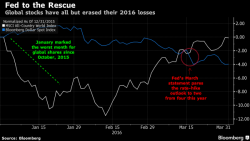

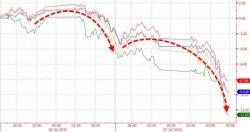

One day after stocks were this close from hitting new all time highs on what have been either ok earnings, if looking at non-GAAP data, or atrocious earnings, based on GAAP, and where any oil headline is now immediately translated as bullish by the oil algos, so far futures are relatively flat, while European stocks were at their moments ago in anticipation of the latest ECB announcement due out in just one hour. However, unlike last month's "quad-bazooka", this time the market expects far less from Draghi.