Global Equities Hit New All Time High Ahead Of The Fed; VIX < 10; Japan Stocks Surge

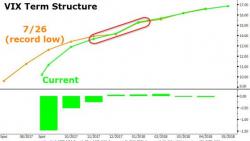

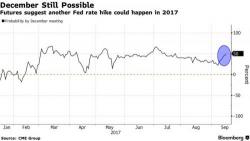

S&P futures are little changed as the Fed begins its two-day FOMC meeting pushing the VIX below 10, down 1.3% and falling for the 7th day; European shares are lower as is the dollar while Japanese stocks soar on the back of a tumbling yen as a snap election in Japan now appears imminent. Despite the cautious action ahead of the Fed, the The MSCI All-Country World Index rose 0.1% to a new record high.