Published

11 seconds ago

on

December 2, 2023

| 52 views

-->

By

Tessa Di Grandi

Graphics & Design

- Sabrina Fortin

The following content is sponsored by iShares

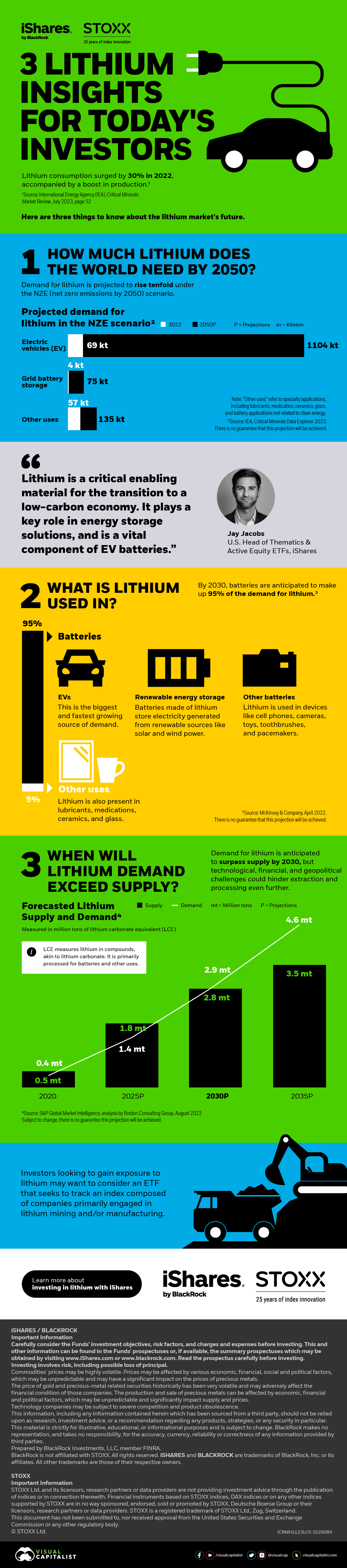

3 Essential Insights for Lithium Investors

The lithium market is experiencing rapid growth, with the critical mineral witnessing a 30% rise in consumption in 2022. But what is causing this lithium boom?

Our sponsor, iShares, takes a look at three insights that are shaping the future of the lithium landscape.

1. Soaring Demand Until 2050

The rapid global shift toward clean energy has set the stage for a surge in lithium demand.

Projections from the IEA show that demand for the so-called white gold is expected to increase tenfold by 2050 in the Net Zero Emissions scenario.

| 2022 (kt) | 2050P (kt) | |

|---|---|---|

| Electric Vehicles | 69 | 1104 |

| Grid Battery Storage | 4 | 75 |

| Other Uses | 57 | 135 |

The reason for this explosive growth comes primarily from lithium’s pivotal role in lithium-ion battery technologies.

2. Lithium’s Dominance in Battery Technology

Lithium-ion batteries are a central piece of the decarbonization puzzle, and could account for approximately 95% of demand by 2030.

These batteries are used to store electricity generated from renewable sources like solar and wind power and are also the dominant technology powering electric vehicles.

3. Lithium Supply Challenges

As the world shifts toward clean energy technologies, lithium supply and demand dynamics are entering uncharted territory.

Forecasts suggest that demand for lithium could outstrip supply as early as 2030.

| Year | Demand (million tons of LCE) | Supply (million tons of LCE) |

|---|---|---|

| 2020 | 0.4 | 0.5 |

| 2025P | 1.4 | 1.8 |

| 2030P | 2.9 | 2.8 |

| 2035P | 4.6 | 3.5 |

Lithium carbonate equivalent (LCE) represents the lithium content in compounds, expressed in terms of lithium carbonate. This form is a primary processed variant of raw lithium, utilized in batteries and various other applications.The projected supply-demand imbalance can be attributed to various factors, including reduced production caused by delays in establishing new mines due to technological challenges and financial limitations, as well as geopolitical complexities within the market.

Navigating the Lithium Frontier

As the world gears up for a net-zero emission future by 2050, lithium has a key role to play in this transformation.

Investors looking to gain exposure to lithium may want to consider an ETF that seeks to track an index composed of companies primarily engaged in lithium mining and/or manufacturing.

Learn more about investing in lithium with iShares

Please enable JavaScript in your browser to complete this form.Enjoying the data visualization above? *Subscribe

Related Topics: #lithium-ion battery #Investor #lithium #iShares #lithium production #lithium supply #lithium reserves

Click for Comments

var disqus_shortname = "visualcapitalist.disqus.com";

var disqus_title = "3 Lithium Insights for Today's Investors";

var disqus_url = "https://www.visualcapitalist.com/sp/3-lithium-insights-for-todays-investors/";

var disqus_identifier = "visualcapitalist.disqus.com-162125";

You may also like

-

Strategic Metals1 day ago

The Critical Minerals to China, EU, and U.S. National Security

Ten materials, including cobalt, lithium, graphite, and rare earths, are deemed critical by all three.

-

Mining2 weeks ago

All the Metals We Mined in One Visualization

This infographic visualizes the 2.8 billion tonnes of metals mined in 2022.

-

Precious Metals2 months ago

200 Years of Global Gold Production, by Country

Global gold production has grown exponentially since the 1800s, with 86% of all above-ground gold mined in the last 200 years.

-

Strategic Metals4 months ago

Charted: America’s Import Reliance of Key Minerals

The U.S. is heavily reliant on imports for many critical minerals. How import-dependent is the U.S. for each one, and on which country?

-

Batteries4 months ago

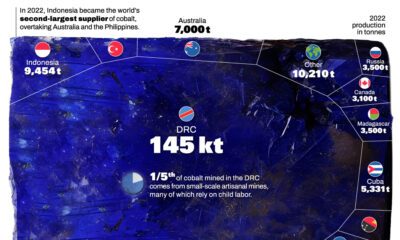

Ranked: The World’s Top Cobalt Producing Countries

Cobalt, an essential component for certain types of EV batteries, has seen a significant shift in its global production landscape.

-

Markets5 months ago

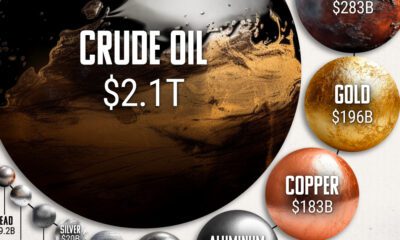

How Big is the Market for Crude Oil?

The oil market is bigger than the 10 largest metal markets combined, with production value exceeding $2 trillion annually.

Subscribe

Please enable JavaScript in your browser to complete this form.Join the 375,000+ subscribers who receive our daily email *Sign Up

The post 3 Lithium Insights for Today’s Investors appeared first on Visual Capitalist.