![]()

See this visualization first on the Voronoi app.

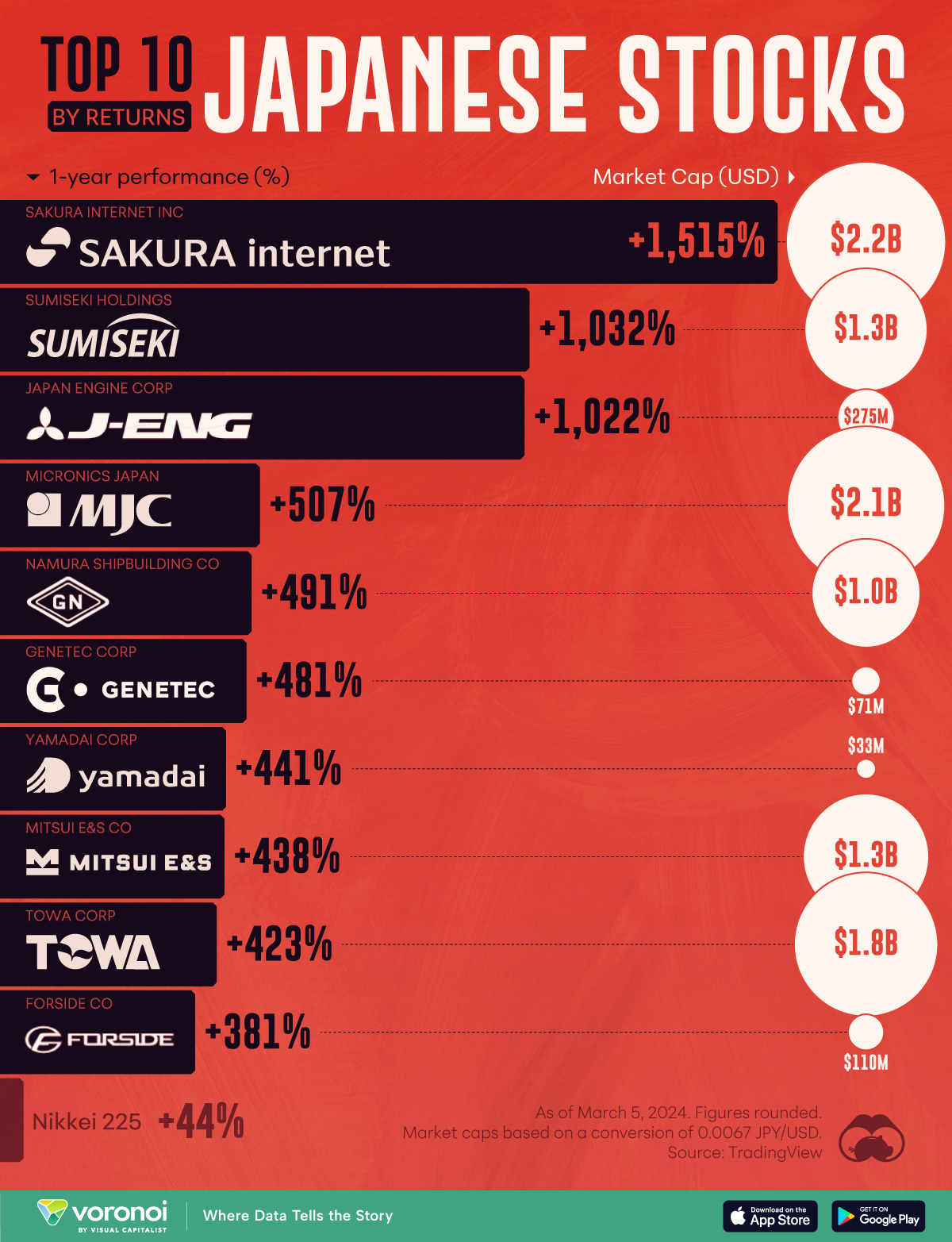

The Best Performing Japanese Stocks (1-Year Returns)

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

On Feb. 22, 2024, the Nikkei 225 (Japan’s leading stock index) closed at 39,098.68, setting a new record high for the first time since 1989. A little over a week later, the index surpassed 40,000 for the first time ever.

To add context to Japan’s recent stock rally, we’ve ranked the top 10 Japanese stocks by their 1-year percentage gains. This is shown by the black bars in the graphic, while market capitalization (in USD) is shown by the white bubbles. All figures are as of March 5, 2024.

The figures we used to create this graphic are listed in the table below.

| Company | Stock Symbol | 1-Yr Performance (%) | Market Cap (USD) |

|---|---|---|---|

| Sakura Internet Inc | 3778 | 1,515 | $2.2B |

| Sumiseki Holdings | 1514 | 1,032 | $1.3B |

| Japan Engine Corp | 6016 | 1,022 | $275M |

| Micronics Japan | 6871 | 507 | $2.1B |

| Namura Shipbuilding Co |

7014 | 491 | $1.0B |

| Genetec Corp | 4492 | 481 | $71M |

| Yamadai Corp | 7426 | 441 | $33M |

| Mitsui E&S Co | 7003 | 438 | $1.3B |

| Towa Corp | 6315 | 423 | $1.8B |

| Forside Co | 2330 | 381 | $110M |

| Nikkei 225 Index | -- | 44 | -- |

While all of these stocks have greatly outperformed the Nikkei 225, just three have grown by over 1,000% over the 1-year period ending March 5, 2024.

Sakura Internet Soars after AI announcement

Japan’s best stock over the past 12 months is Sakura Internet Inc., which offers a variety of internet services like cloud computing and home internet.

The stock rallied after it was announced that Sakura would be building a supercomputer designed to develop generative AI models. On top of that, the Japanese government is expected to cover half of the computer’s cost.

The Nikkei 225 Experiences a Pullback

Unfortunately, nothing moves in a straight line. Since closing at 40,109.23 on March 4, 2024, the Nikkei 225 index has fallen 3.6%, closing at 38,695.97 on March 13.

Some believe this dip will be short-lived, and that the rally will continue throughout the year. Japanese companies have reported strong earnings as of late, partly thanks to a weak yen, which benefits many of the country’s export-reliant companies.

Another reason is the creation of the Nippon Individual Savings Account (NISA), which encourages Japanese households to invest more of their savings in domestic equities.

If you’re interested in learning more about the Japanese stock market, consider this graphic which illustrates the country’s 25 largest companies by market cap.

The post The Best Performing Japanese Stocks (1-Year Returns) appeared first on Visual Capitalist.