India’s FDI Inflows Over the Last 20+ Years

In 2022, India ranked 10th in top destinations for foreign direct investment (FDI), a culmination of decades of economic and policy reforms.

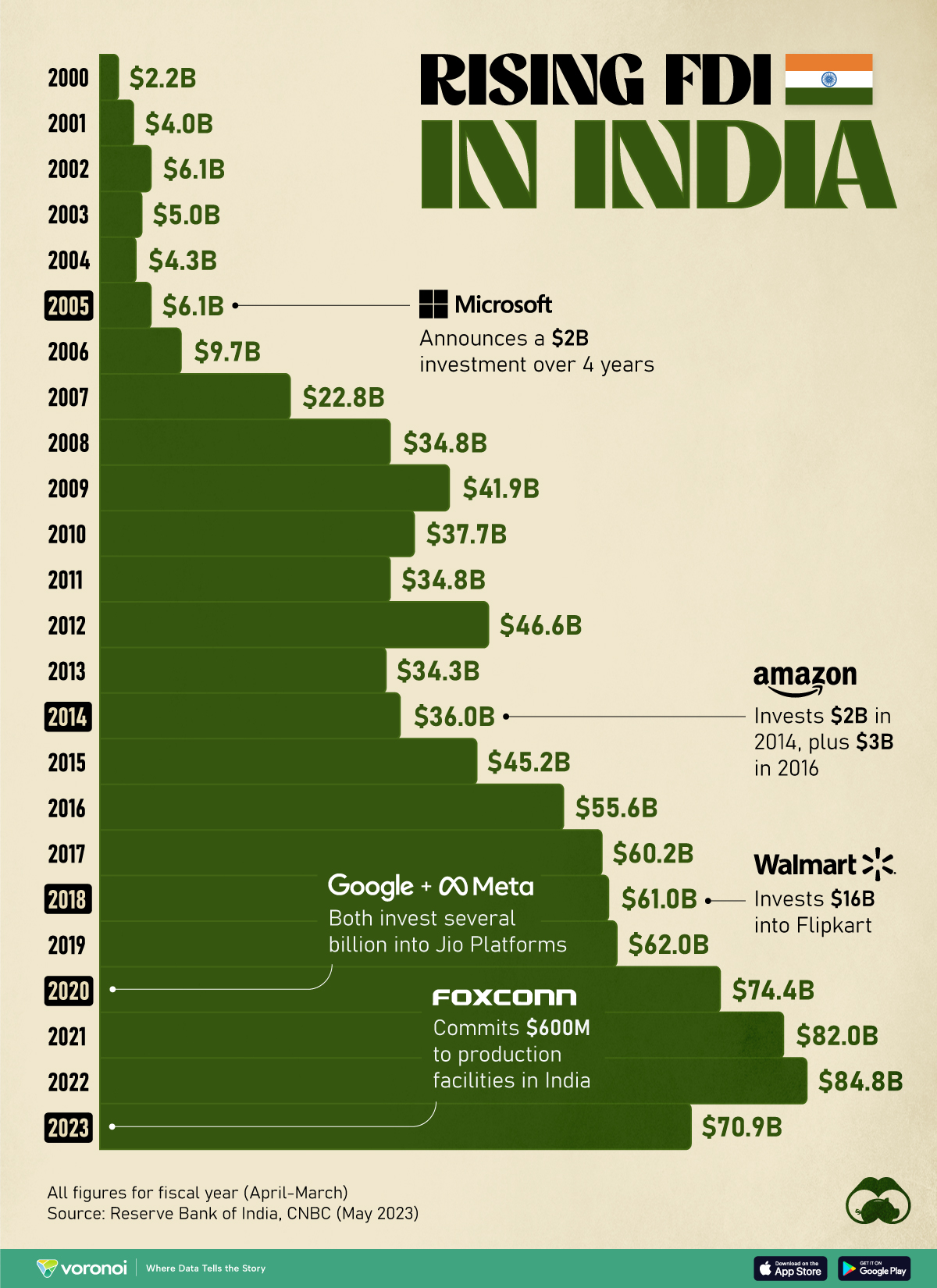

We visualize how India’s FDI inflows have increased since 1999–2000, using data sourced from the Reserve Bank of India, and sourced from S&P Global. Data is current up to financial year 2022–2023, which ended March 2023.

India’s FDI Journey Between 2000 And 2023

Facing a severe balance of payments crisis in 1991, the Indian economy liberalized with a slew of economic reforms aimed at reducing import tariffs and “opening up” sectors to foreign investment.

As a result, foreign direct investment to the country trended upwards, gathering steam at the start of the new century. India’s FDI inflows rocketed from $2.2 billion in 1999–2000 to more than $22 billion in 2006–2007, mirroring the country’s rapid economic growth.

In the midst of the subprime crisis and the global recession, investment to the country stayed resilient due to the country’s vast, and fairly insulated, domestic market.

Here’s a look at India’s FDI inflows over the last two decades.

| Year | India's FDI Inflows |

|---|---|

| FY 1999–00 | $2.2B |

| FY 2000–01 | $4.0B |

| FY 2001–02 | $6.1B |

| FY 2002–03 | $5.0B |

| FY 2003–04 | $4.3B |

| FY 2004–05 | $6.1B |

| FY 2005–06 | $9.7B |

| FY 2006–07 | $22.8B |

| FY 2007–08 | $34.8B |

| FY 2008–09 | $41.9B |

| FY 2009–10 | $37.7B |

| FY 2010–11 | $34.8B |

| FY 2011–12 | $46.6B |

| FY 2012–13 | $34.3B |

| FY 2013–14 | $36.0B |

| FY 2014–15 | $45.2B |

| FY 2015–16 | $55.6B |

| FY 2016–17 | $60.2B |

| FY 2017–18 | $61.0B |

| FY 2018–19 | $62.0B |

| FY 2019–20 | $74.4B |

| FY 2020–21 | $82.0B |

| FY 2021–22 | $84.8B |

| FY 2022–23 | $70.9B |

Note: India’s financial year runs from April–March.

Looking to capitalize on the country’s burgeoning demand, global brands have made increasingly large plays into the country’s economy. Some notable investments of the last decade include:

- 2014: Amazon invests $2B into country operations in 2014, plus $3B in 2016.

- 2018: Walmart invests $16B into Flipkart—an Indian e-commerce platform.

- 2020: Google & Meta invest $4.5B and $5.7B respectively into India’s largest telecom provider, Jio Platforms.

- 2023: Foxconn commits $600M to production facilities in India.

This has been boosted by the government’s continued push to liberalize it’s FDI laws. For example, in 2021, the government did away with FDI caps in the country’s telecom, oil, and defense industries.

The country’s top five sources of FDI inflows include Mauritius, Singapore, and the United States. As for China, despite being a large trading partner, the country’s investments in India have been impacted by a 2020 ruling necessitating additional screening for FDI investments from bordering countries.

Top Indian States To Receive FDI Inflows

It’s also important to note that India’s FDI flows are not distributed equally across the country.

Just three Indian states: Maharashtra, Karnataka, and Gujarat, became the destination of 70% of the $70.9 billion foreign investment between April 2022 and March 2023.

This also mirrors the inequality in what sectors the incoming FDI is chasing.

Two sectors—services (Banking, Finance, Insurance ) and tech account for one-third of all FDI inflows. Despite the government’s flagship “Make in India” campaign (2014), manufacturing (excluding automobile manufacturing) is still not a top-five sector for foreign investors.

The post Charted: India’s FDI Inflows Over the Last 20+ Years appeared first on Visual Capitalist.