Published

37 mins ago

on

November 1, 2023

| 38 views

-->

By

Jenna Ross

Graphics & Design

- Jennifer West

- Alejandra Dander

The following content is sponsored by Morningstar

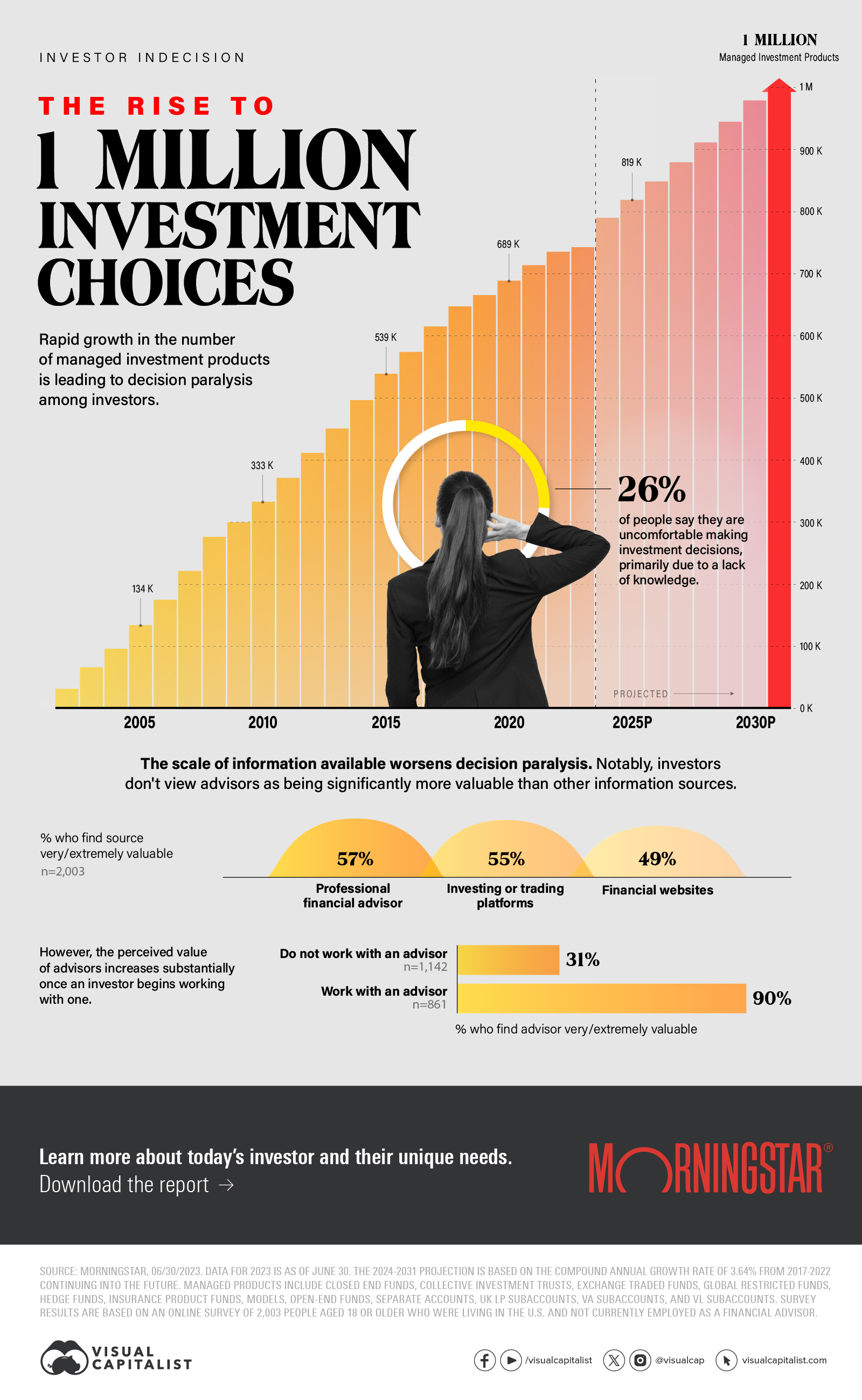

Decision Paralysis: The Rise to One Million Investment Choices

By 2031, there could be one million managed investment products. As the number of investment choices grows, investors are suffering from decision paralysis.

We partnered with Morningstar to show the rise in investment products over time, and how financial advisors can help.

Investment Product Growth Over Time

There were just over 30,000 managed investment products in 2002, but the choices grew rapidly in the years that followed. As of June 30, 2023, there were more than 742,000 products available.

| Year | Number of Managed Investment Products |

|---|---|

| 2002 | 31,470 |

| 2003 | 66,225 |

| 2004 | 96,050 |

| 2005 | 133,967 |

| 2006 | 175,001 |

| 2007 | 221,417 |

| 2008 | 276,115 |

| 2009 | 299,882 |

| 2010 | 332,693 |

| 2011 | 371,224 |

| 2012 | 411,414 |

| 2013 | 450,744 |

| 2014 | 496,460 |

| 2015 | 539,013 |

| 2016 | 573,999 |

| 2017 | 615,025 |

| 2018 | 647,483 |

| 2019 | 665,622 |

| 2020 | 688,700 |

| 2021 | 713,635 |

| 2022 | 735,474 |

| 2023 | 742,715 |

| 2024P | 790,018 |

| 2025P | 818,789 |

| 2026P | 848,608 |

| 2027P | 879,512 |

| 2028P | 911,542 |

| 2029P | 944,739 |

| 2030P | 979,144 |

| 2031P | 1,014,802 |

Source: Morningstar, 2023 data is as of June 30. Managed products include closed end funds, collective investment trusts, exchange traded funds, global restricted funds, hedge funds, insurance product funds, models, open-end funds, separate accounts, UK LP subaccounts, VA subaccounts, and VL subaccounts.

In terms of the different product types, open-ended mutual funds are the most common. However, ETFs have seen the highest growth rate over the last two decades.

Growth rates for all managed products in total were the highest in the early 2000s, but the number of products has continued to grow in recent years. The projection of one million products by 2031 assumes the compound annual growth rate of 3.64% from 2017 to 2022 continues into the future.

Enjoying this content? Dive into more insights in the Voice of the Investor Report:

Overcoming Decision Paralysis

People have access to more investment products and more advice than previous generations, but this doesn’t necessarily translate to more knowledge. Instead, this can lead to confusion and decision paralysis. In fact, 26% of people say they are uncomfortable making investment decisions, primarily due to a lack of knowledge.

Notably, investors don’t view advisors as being significantly more valuable than other information sources.

| Source | % Who Find Source Very/Extremely Valuable |

|---|---|

| Professional advisor | 57% |

| Investment or trading platform/website | 55% |

| Accountant or tax advisor | 53% |

| Business news e.g. Wall Street Journal | 50% |

| Financial websites e.g. Yahoo Finance | 49% |

Source: Morningstar’s 2023 Voice of the Investor Study. The study is based on 2,003 U.S. adults who were not currently employed as a financial advisor.

However, the perceived value of advisors increases substantially once an investor begins working with one.

| Status of Advisor Relationship | % Who Find Advisor Very/Extremely Valuable |

|---|---|

| Do not work with an advisor (n=1,142) | 31% |

| Work with an advisor (n=861) | 90% |

To help combat decision paralysis, advisors can provide actionable insights and curate options for investors. Want to learn more about today’s investors and their unique needs?

Download Morningstar’s Voice of the Investor report.

Please enable JavaScript in your browser to complete this form.Enjoying the data visualization above? *Subscribe

Related Topics: #investing #financial advisor #Morningstar #investment choices #investment products #decision paralysis #choice paralysis

Click for Comments

var disqus_shortname = "visualcapitalist.disqus.com";

var disqus_title = "Decision Paralysis: The Rise to One Million Investment Choices";

var disqus_url = "https://www.visualcapitalist.com/sp/decision-paralysis-the-rise-to-one-million-investment-choices/";

var disqus_identifier = "visualcapitalist.disqus.com-161915";

You may also like

-

Real Estate6 days ago

Ranked: The Cities With the Most Bubble Risk in Their Property Markets

Despite higher mortgages and sharply correcting prices, some cities’ property markets are still in bubble-risk territory.

-

Stocks1 week ago

Charted: The Key Investment Theme of Each Decade (1950-Today)

Here are the investment themes that have defined each decade from the ‘Nifty Fifty’ to the tech giants of the 2010s.

-

Economy1 week ago

Ranked: The Fastest Growing Economies In 2024

This graphic uses the latest IMF projections to rank the world’s top 20 fastest growing economies for 2024.

-

Markets1 week ago

Charted: Comparing the GDP of BRICS and the G7 Countries

As BRICS is set to add six new countries, how does the bloc and its new members’ GDP compare with that of the G7?

-

Travel1 week ago

Ranked: Which Airlines Carried the Most Passengers in 2022?

Four airlines headquartered in the U.S. are amongst the top ranks of the largest airlines by passengers in 2022.

-

Markets2 weeks ago

Charted: 50 Years of Music Industry Revenues, by Format

The music industry has undergone a remarkable transformation in formats. See how its revenues have evolved, from vinyl and CDs to streaming.

Subscribe

Please enable JavaScript in your browser to complete this form.Join the 375,000+ subscribers who receive our daily email *Sign Up

The post Decision Paralysis: The Rise to One Million Investment Choices appeared first on Visual Capitalist.