Via Macro-Man blog,

Your view of the broader significance of this weekend's failed Doha summit directly relates, in all likelihood, to your pre-existing view on asset markets. If you are of a bearish mindset, then of course the failure of oil producers to freeze production is bad news, and renders predictions of "supply/demand balance by H2" as little more than a wishcast. The implication, it need not be said, is bearish for risky assets. If you're more constructive, on the other hand, it's easy to say that many asset markets have shrugged off tepid growth and lousy earnings and negative rates for awhile now...why shouldn't they continue to do so?

Macro Man was fortunate enough to sit in on a debate between two well-known commentators discussing the weekend summit. They generously allowed him to record it and share with readers, who can listen via the soundcloud below:

https://w.soundcloud.com/player/

Seriously though, you can muster the same data to provide a "compelling" argument to favour whatever view you happen to hold.

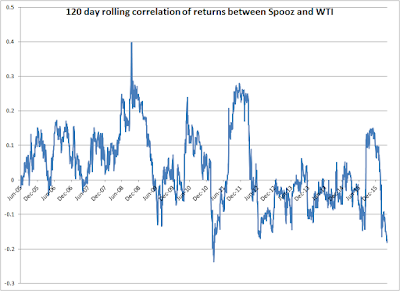

Let's look at something as simple as the correlation between crude and Spooz. Macro Man ran the 120 day rolling correlation between Spooz and the crude price going back to 2005:

That's a pretty darned high correlation, right? And it makes sense, because of the underlying narrative of financial market volatility via the high yield debt markets due to impoverished shale producers. As such, the 5.6% decline in WTI bodes ill for risky assets, as evidenced by price action in equity futures, FX, and fixed income thus far on Sunday.

OK fine, but what if we run the same 120 day correlation on daily returns, rather than price? After all, if there were really a strong causal relationship between the two markets, we'd expect to see it show up on a day-to-day basis, right? Or B). The 120 day rolling correlation of returns is actually negative; indeed, it's rarely been more negative over the last decade.

That's a pretty darned low correlation, right? And it makes sense, because there are a myriad of factors that impact broad equity markets, of which the oil patch is only a small part. As such, any any moderate weakness in crude this week is actually good news for stocks, as it provides an ongoing boon to the large section of the economy that benefits from low oil prices and will keep the Fed's hands firmly in their pockets.

If you're so inclined, choose the chart and explanatory paragraph that best suits you view. For choice, Macro Man retains his small speculative short in Spooz and does wonder if the Doha thing may just alter the narrative enough to encourage some profit-taking from tactical longs. We could perhaps see similar in BRL, where Dilma's lost impeachment vote could see some "sell the fact" profit taking. Soon enough, Macro Man will know whether to say "Doh!" or "ha ha".