This Bill In Congress Could Means 10s Of 1000s More Americans Banned From Buying Guns

Authored by Michael Snyder via The American Dream blog,

Authored by Michael Snyder via The American Dream blog,

It’s fairly easy to categorize Patrick Byrne, the founder of Overstock.com, as a visionary, although he is usually described in less glowing terms in the mainstream media, a typical adjective being “controversial”. Byrne founded the $1.4 billion internet retailer of mainly “closeout” merchandise in 1997. In January 2014, Overstock became the first major online retailer to accept Bitcoin in payment for goods. Byrne explained how he became an advocate of cryptocurrencies in an interview with Adam Taggart of PeakProsperity.com.

Over 10,000 text messages sent between two top FBI investigators - one of whom led both the Clinton email investigation and the early Trump-Russia probe, have been turned over to Congress Tuesday evening and promptly leaked to the press. The profanity-laced messages reveal a deep hatred for Trump between veteran agent Peter Strzok and FBI attorney Lisa Page, who were having an extramarital affair while working together on the Clinton email investigation when the texts were exchanged.

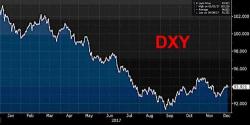

After an early slide last night following the stunning news that Doug Jones had defeated Republican Roy Moore in the Alabama special election, becoming the first Democratic senator from Alabama in a quarter century and reducing the GOP's Senate majority to the absolute minimum 51-49, US equity futures have quickly rebounded and are once again in the green with the S&P index set for another record high, as European stocks ease slightly, and Asian stocks gain ahead of today's Fed rate hike and US CPI print.

Authored by Paul Craig Roberts,

Is the US really a superpower or just the biggest collection of stupidity on the planet?

Washington has already lost the Syrian war once. Now it is about to lose it a second time.

A few days ago the president of Russia, Vladimir Putin, declared a “complete victory” in Syria:

“Two hours ago, the (Russian) defense minister reported to me that the operations on the eastern and western banks of the Euphrates have been completed with the total rout of the terrorists.”