2017 Will Be The Worst Year For US Retail In History

Authored by Michael Snyder via The Economic Collapse blog,

Not even during the worst parts of the last recession did things ever get this bad for the U.S. retail industry.

Authored by Michael Snyder via The Economic Collapse blog,

Not even during the worst parts of the last recession did things ever get this bad for the U.S. retail industry.

Authored by John Whitehead via The Rutherford Institute,

My hometown of Charlottesville, Va., has become the latest poster child in a heated war of words - and actions - over racism, “sanitizing history,” extremism (both right and left), political correctness, hate speech, partisan politics, and a growing fear that violent words will end in violent actions.

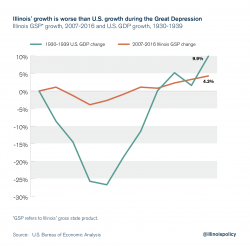

Authored by Michael Lucci via IllinoisPolicy.org,

Illinois’ total state economic activity has increased by only 4 percent since 2007, which is lower than the U.S.’ 10 percent GDP growth during the worst decade of the Great Depression.

Authored by Paul Craig Roberts,

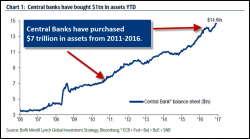

For 66 years the Glass-Steagall act reduced the risks in the banking system. Eight years after the act was repealed, the banking system blew up threatening the international economy. US taxpayers were forced to come up with $750 billion dollars, a sum much larger than the Pentagon’s budget, in order to bail out the banks. This huge sum was insufficient to do the job. The Federal Reserve had to step in and expand its balance sheet by $4 trillion in order to protect the solvency of banks declared “too big to fail.”

Authored by Steve St.Angelo via SRSroccoReport.com,

The Central banks bought a staggering $1.5 trillion in assets in the first five months of the year to keep the economy from imploding while at the same time, capping the gold price. Yes, it’s true…. $300 billion a month of Central bank asset purchases pushes up STOCK, BOND and REAL ESTATE values while it depresses or caps the gold (or silver) price.