Weekend Reading: And... It's Only Week Two

Submitted by Lance Roberts via RealInvestmentAdvice.com,

As we conclude week two of the new Presidential cycle, it certainly has not been dull.

Submitted by Lance Roberts via RealInvestmentAdvice.com,

As we conclude week two of the new Presidential cycle, it certainly has not been dull.

Via The Daily Bell

Trump to sign executive actions targeting Obama financial regulations … The president is expected to sign a pair of executive orders targeting rules imposed on the financial sector Friday, according to senior White House officials.

The president has signed two executives order that will free up the ability for companies and Wall Street to function with less paperwork and regulatory reporting.

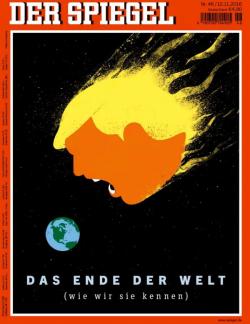

As President-Elect Trump visited Washington in December, and received calls from world leaders, Germany's Der Spiegel magazine makes it clear just what the European establishment thinks of The Donald's future...

And now, with President Trump having taken office, the German media (having exclaimed his inauguration address as "a declaration of war"), have dropped their latest cover-bomb, dubbed "America First"...

... clearly, Europe - or at least Spiegel - is confident it is next.

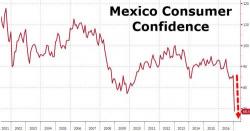

While the biggest threat facing Mexico, and its unpopular president Enrique Pena Nieto, in the past month has been President Trump's insistence on building a "Massive Wall", which Mexico would pay for, as well as Trump's threats of renegotiating NAFTA, today we got a fresh reminder that America's neighbor to the south has another looming problem: a rapidly deteriorating economy coupled with surging inflation on the back of the recent 20% price hike for gasoline, which culminated in a record crash in Mexican consumer confidence.

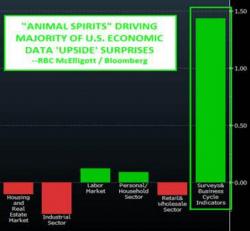

Following today's jobs report, the market's reaction to the unexpectedly strong January payrolls visualized in the charts below, is straightforward: the disappointing wage growth is an indication that the Fed may not hike rates for quite a bit longer than expected, and will likely will be forced to reduce its rate hike expectations from 3 to 2 (in line with the market) or fewer if wage growth continue to stagnate.