U.S. Startups Increasingly Tapping Debt Markets As VCs Pullback From Egregious Valuations

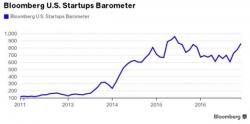

After investing nearly $80 billion into startups in 2015, Venture Capitalists, growing slightly weary of the $1 billion valuations being handed out like candy to every 22 year old with an app that can replace your face with that of panda, have pulled back a bit in 2016 resulting in a 10% reduction in equity capital for America's graduating snowflakes. But as Bloomberg points out, that's not a problem as many of Silicon Valley's revenue-free startups see debt capital as a better alternative anyway...sure, what could go wrong?