Silver Prices Bounce Higher After Futures Manipulated 7% Lower In Minute

Silver Prices Bounce Higher After Futures Manipulated 7% Lower In Minute

Silver Prices Bounce Higher After Futures Manipulated 7% Lower In Minute

S&P futures are little changed following yesterday's rout even as Asian and European markets continued selling; the pound slid on poor factory data, the yen tumbled after the BOJ intervened to stabilize the JGB bond market, precious metals flash crashed early in the session, while the selloff in oil accelerated despite yesterday's massive inventory draw, although at least yesterday's sharp bond tantrum has stabilized.

Content originally published at iBankCoin.com

Thoughts on this?

Jingoism and nationalistic fervor are often reviled by both leftists and cynics. In my younger years, I regaled in the glory of America -- up until the point that I felt it was being used to emotionally control people to pursue an agenda that ran counter to the best interests of the people.

Submitted by Ronan Manly, BullionStar.com

Sometime in the coming days, the London Bullion Market Association (LBMA) plans to begin reporting the amount of real physical gold and silver that is actually stored in the network of LBMA vaults in London. This follows an announcement made by the LBMA on 8 May.

There are 7 commercial vault operators (custodians) in the LBMA custodian vault network namely:

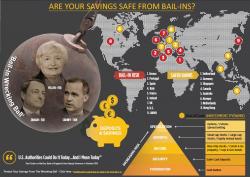

Precious Metals Are "Best Defence" Against Bail-ins In Economic Crisis

Precious metals are "real assets" and "best defence" against bail-ins and cashless society in the economic crisis which is "on its way"