Published

3 mins ago

on

July 25, 2025

| 4 views

-->

By

Julia Wendling

Graphics & Design

- Jennifer West

The following content is sponsored by Global X

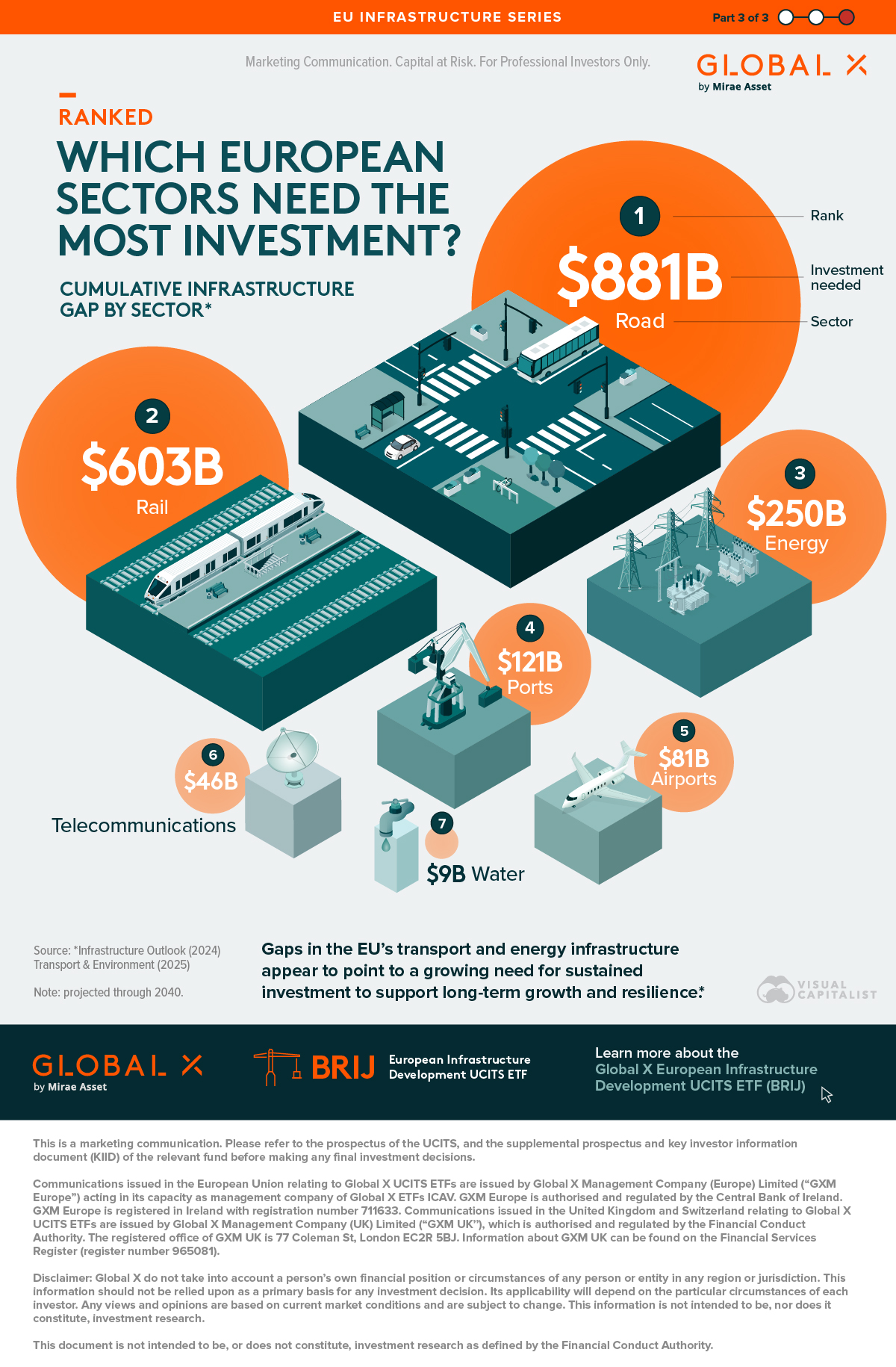

Ranked: Which European Sectors Need the Most Investment?

Europe’s infrastructure is under pressure—but not all sectors are being hit equally.

This graphic, created in partnership with Global X, visualizes which areas of the economy require the most investment to close Europe’s widening infrastructure gap, based on data from Infrastructure Outlook.

The $2 Trillion European Infrastructure Gap

Part 2 of this series highlighted that Europe could face a $2 trillion infrastructure shortfall by 2040—up from about $538 billion in 2024.

However, while every sector needs attention, some are in far more urgent need of funding. Which ones have the largest shortfalls?

A Sectoral Look at the Deficit

The top two sectors with the largest investment deficits fall under the transportation umbrella. Roads face the largest gap at an estimated $881 billion, followed by railways at $603 billion.

Energy ranks third with a $250 billion deficit. Investment in this sector is critical for meeting the EU’s 2050 net-zero goals through investment in green technologies.

| Sector | Cumulative Infrastructure Gap ($ billions) |

|---|---|

| Road | 881 |

| Rail | 603 |

| Energy | 250 |

| Ports | 121 |

| Airports | 81 |

| Telecommunications | 46 |

| Water | 9 |

Other key gaps include ports ($121 billion), airports ($81 billion), and telecommunications ($46 billion). The latter sector is crucial to meet the EU’s goals to digitize its economy across sectors in the post-pandemic recovery era. Water infrastructure has an estimated shortfall of $9 billion by 2040.

A Global Look at Infrastructure Needs

Globally, roads also lead the investment gap, with a projected $8.0 trillion shortfall by 2040. That’s followed by:

- Energy: $2.9 trillion

- Rail: $1.1 trillion

- Telecommunications: $1.0 trillion

- Water: $713 billion

- Ports: $555 billion

- Airports: $530 billion

Overall, Infrastructure Outlook expects the global infrastructure investment gap to reach $15 trillion by 2040.

Supporting Long-Term Growth

Europe’s transport and energy systems are showing the deepest cracks—underscoring the urgent need for long-term, strategic investment to support economic resilience and sustainable growth.

Learn more about the Global X European Infrastructure Development UCITS ETF (BRIJ).

More from Global X

-

Economy7 mins ago

Charted: Europe’s $2 Trillion Infrastructure Investment Deficit

This graphic, created in partnership with Global X, offers visual context to Europe’s widening infrastructure investment gap, using data from Infrastructure Outlook.

-

Economy18 mins ago

Breaking Down the €286 EU Billion Infrastructure Spend

This visualization, created in partnership with Global X, offers a clear look at where RRF grants and loans are being directed in the EU, based on…

-

Politics3 weeks ago

Breaking Down the West’s $146 Billion 2024 Defence Technology Investment

Visual Capitalist has partnered with Global X ETFs to break down the $146 billion spent on defence technology by the U.S. and the EU.

-

Politics3 weeks ago

Mapped: How NATO Defence Spending Has Changed Since the Ukraine-Russia War

Visual Capitalist has partnered with Global X ETFs to explore how NATO defence spending has changed since the start of the Ukrain-Russia war.

-

Politics3 weeks ago

Visualized: Global Defence Spending in 2024

Visual Capitalist has partnered with Global X ETFs to explore global defence spending and find out which nation spends the most on defence.

-

Economy2 months ago

Breaking Down the 117th Congress’s $1.2T Infrastructure Investment

Graphic showing U.S. infrastructure investment highlighting that investment is primarily going to roads, bridges, and other major projects.

-

Economy2 months ago

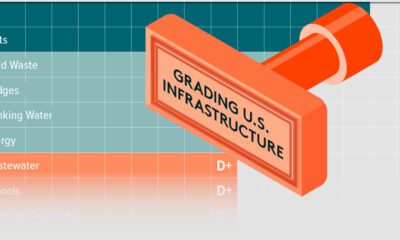

Report Card: Grading U.S. Infrastructure

This graphic shows U.S infrastructure grades and highlights the general low grade.

-

Energy7 months ago

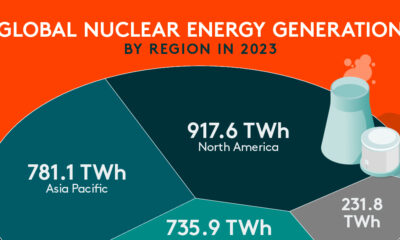

Nuclear Energy Supply Forecast by Region

Visual Capitalist and Global X partnered to explore global nuclear energy demand, and how it’s changing, in the coming years.

-

Energy7 months ago

Charted: $300 Billion in Global Nuclear Energy Investment

Visual Capitalist and Global X partnered to explore nuclear energy investment and find out which regions spent the most on nuclear power.

-

Energy7 months ago

Visualized: Nuclear Energy Generation by Region

Visual Capitalist and Global X ETFs explore regional nuclear energy generation and why nuclear energy is critical to the energy transition.

-

Technology9 months ago

Ranked: Which Countries Have the Most Data Centers?

For this graphic, Visual Capitalist partnered with Global X ETFs to rank the nations by the number of data centers they currently operate.

-

Technology9 months ago

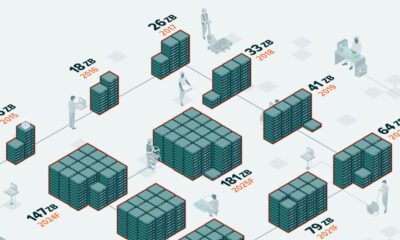

Charted: How Much Data is Stored Online?

For this graphic, Visual Capitalist has partnered with Global X ETFs to explore online data generation and show how much data could be generated between 2015…

-

Technology9 months ago

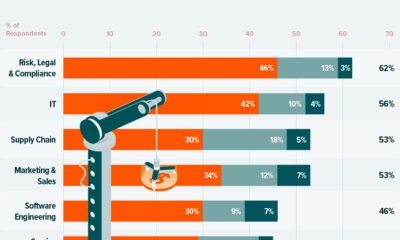

Visualized: The Impact of AI on Revenue

In this graphic, Visual Capitalist has partnered with Global X ETFs to explore the financial impact of AI adoption across various industries.

-

Green1 year ago

Mapped: U.S. Investment in Sustainable Infrastructure (2021-2023)

This graphic shows high levels of investment in U.S. clean infrastructure between 2021 and 2023.

-

Technology2 years ago

Visualized: What is the Artificial Intelligence of Things?

Explore the explosive growth of the Artificial Intelligence of Things (AIoT) industry and its transformative impact across sectors.

-

Technology2 years ago

A Visual Guide to AI Adoption, by Industry

AI adoption impacts many industries, with finance leading. Discover how AI tools optimize operations, mitigate risks, and drive growth.

-

Technology2 years ago

Ranked: Artificial Intelligence Startups, by Country

Find out which countries are winning the race when it comes to the number of AI startups and private investment .

-

Technology2 years ago

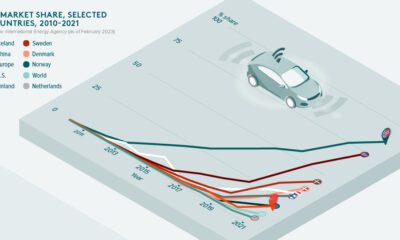

On the Road to Electric Vehicles

Electric vehicles are playing a key role in the decarbonization of road transport. But how much further do we need to go to hit net zero?

-

Mining3 years ago

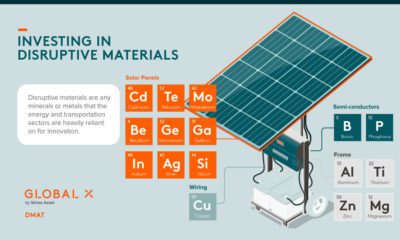

Should You Invest in Disruptive Materials?

Disruptive materials are experiencing a demand supercycle. See how these materials are helping revolutionize next generation technologies.

-

Technology3 years ago

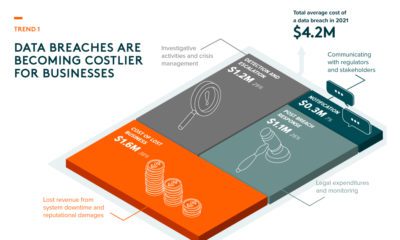

Thematic Investing: 3 Key Trends in Cybersecurity

Cyberattacks are becoming more frequent and sophisticated. Here’s what investors need to know about the future of cybersecurity.

Subscribe

Please enable JavaScript in your browser to complete this form.Join the 375,000+ subscribers who receive our daily email *Sign Up