Stocks, Dollar Tumble As Gold Tops $1250; Dead Bill Bounce Dies

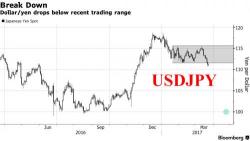

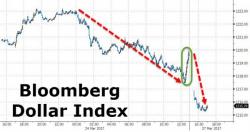

It appears the false narrative of the failed healthcare reform bill being somehow great news for stocks has been eviscerated in early Asia trading. The dollar has tumbled to its lowest since Nov 10th, Gold has ripped back above $1250, and S&P futures have plunged to 6 week lows.

The Bloomberg Dollar Index has almost erased the entire post-Trump-election gains...

US equity futures are tumbling - Dow is down over 700 points from its highs...

And gold is back above $1250...