![]()

See this visualization first on the Voronoi app.

Use This Visualization

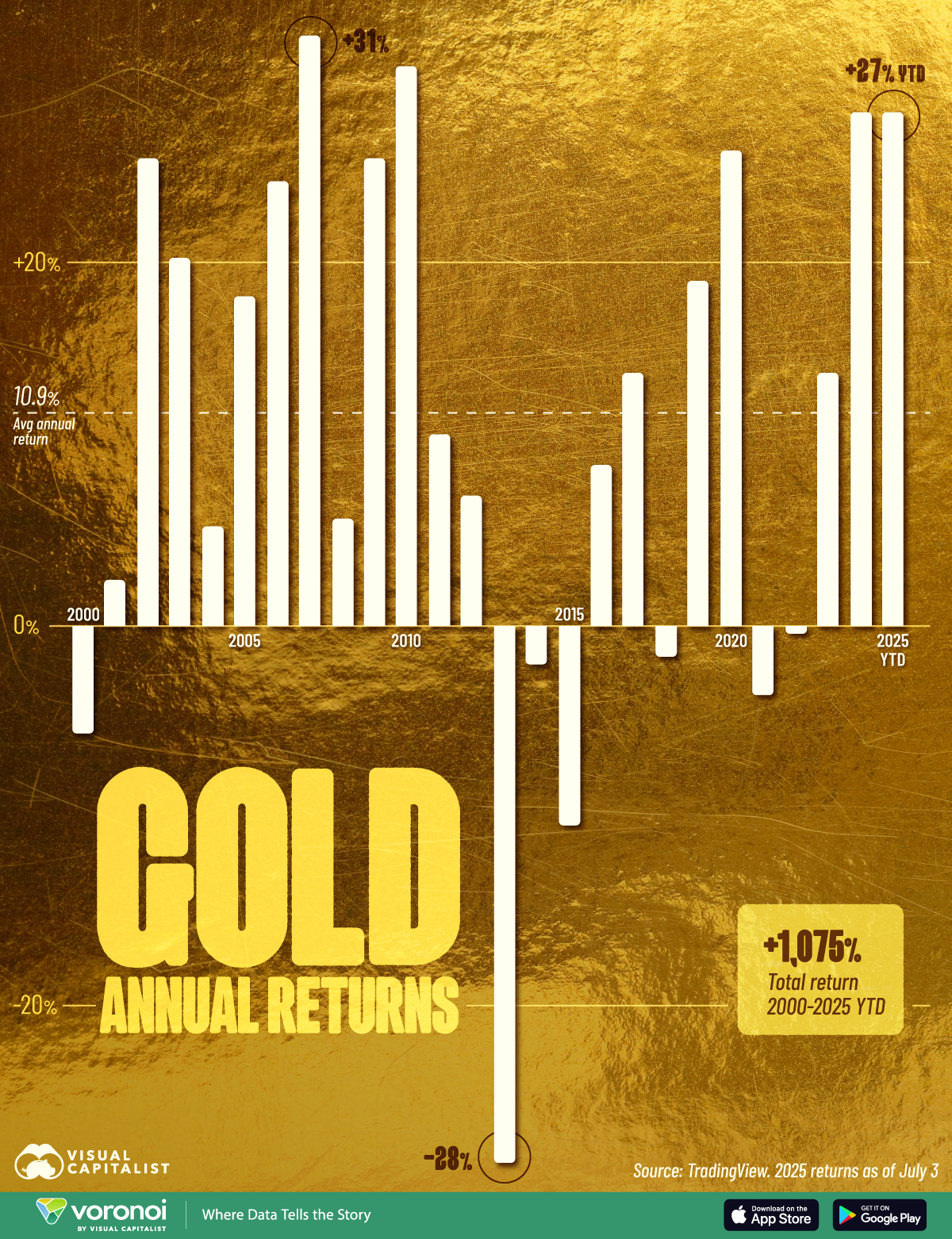

Visualized: Gold’s Annual Returns from 2000 to 2025 YTD

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Key Takeaways

- Gold prices are up 1,075% from 2000 to 2025 (YTD as of July 3)

- On average, gold has delivered a 10.9% annual return over 25 years

- 2025 is one of gold’s best years in terms of returns, up 27% as of July 3, 2025

Over the last 25 years, gold has been a relatively stable asset class for investors looking for diversification, a hedge against inflation, or a safe haven in uncertain times.

From 2000 to 2025, the precious metal has delivered a staggering 1,075% return for patient investors.

This chart shows the annual returns of gold from 2000 through 2025 (YTD as of July 3), based on data from TradingView.

Gold Shines When It Rains

On average across the 25 years, gold’s price has increased by 10.9% annually, although it has seen some volatility.

Here’s how gold has performed every year from 2000 to 2025:

| Year | Gold Annual Returns |

|---|---|

| 2000 | -5.4% |

| 2001 | 2.4% |

| 2002 | 24.8% |

| 2003 | 19.5% |

| 2004 | 5.4% |

| 2005 | 17.5% |

| 2006 | 23.5% |

| 2007 | 31.0% |

| 2008 | 5.6% |

| 2009 | 24.6% |

| 2010 | 29.6% |

| 2011 | 10.1% |

| 2012 | 7.1% |

| 2013 | -28.0% |

| 2014 | -1.8% |

| 2015 | -10.4% |

| 2016 | 8.4% |

| 2017 | 13.2% |

| 2018 | -1.6% |

| 2019 | 18.3% |

| 2020 | 25.1% |

| 2021 | -3.6% |

| 2022 | -0.4% |

| 2023 | 13.2% |

| 2024 | 27.2% |

| 2025 YTD | 27.0% |

Periods of global crisis—such as the 2008 financial crisis, the COVID-19 pandemic, or inflation spikes—have typically seen investors flock to gold, pushing up returns.

Gold’s best years include 2007 (+31%) and 2010 (+29.6%), leading up to and following the Global Financial Crisis. It also delivered stellar returns of 25% in 2020, and has shone brightly among other asset classes over the last two years, with gold prices up around 27% in 2024 and 2025 (YTD as of July 3).

On the other hand, gold’s biggest drawdown was in 2013, when prices dropped by 28% from historical highs. However, this was following a decade of consistent positive returns from 2001 to 2012.

Will Gold Continue to Shine?

Amid the ongoing global economic slowdown, trade uncertainty, and mounting risks of a recession, gold has been one of the best-performing major asset classes so far in 2025.

Following two consecutive years of strong performance, returns may be subdued in 2026. However, with major central banks—including those of China, India, and Russia—continuing to accumulate gold, the precious metal’s role as a long-term store of value appears far from over.

Learn More on the Voronoi App ![]()

See how gold’s performance since 2020 compares to other asset classes in this infographic on Voronoi, the new app from Visual Capitalist.