![]()

See this visualization first on the Voronoi app.

Use This Visualization

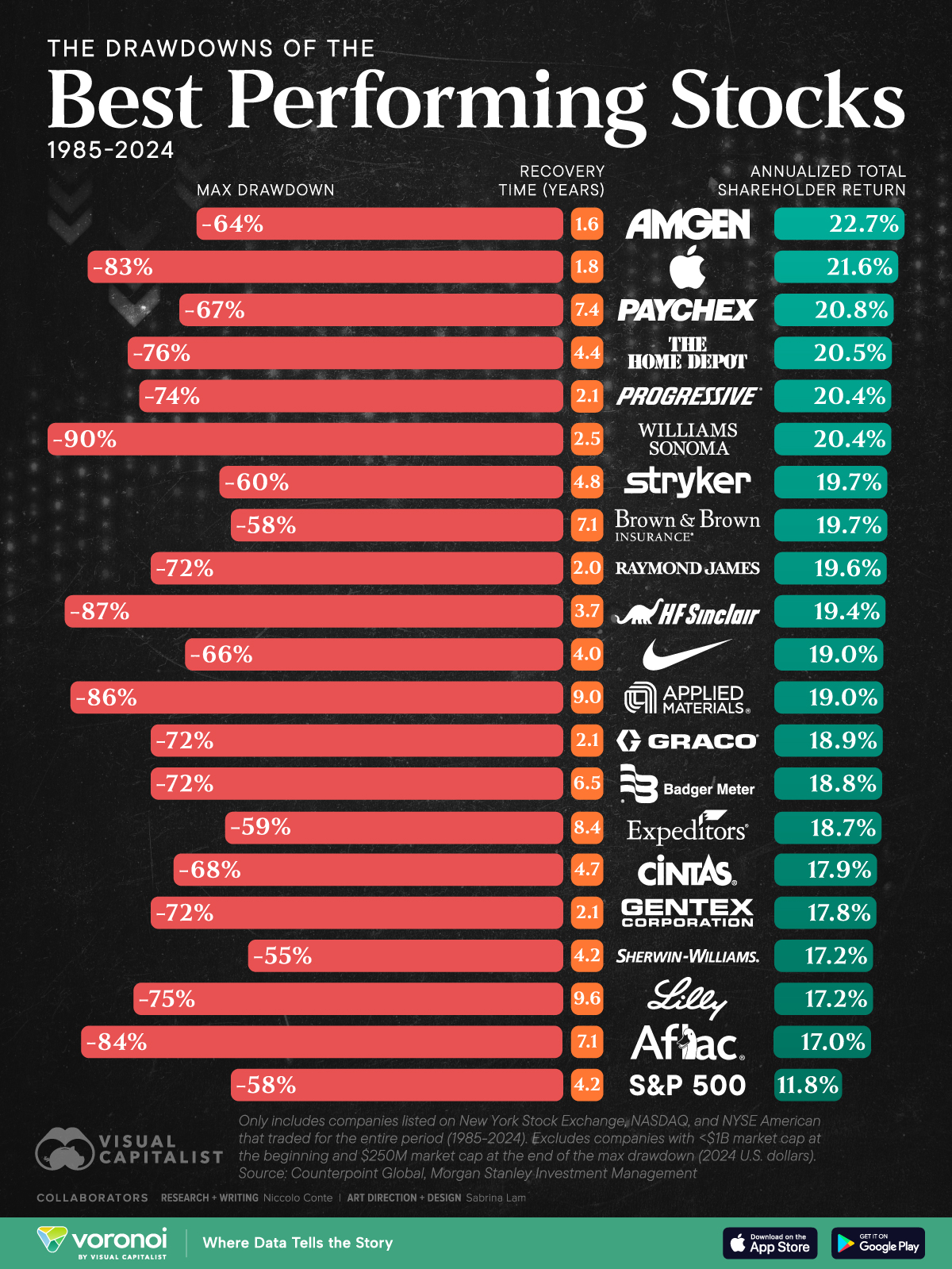

Charted: The Drawdowns of the Best-Performing U.S. Stocks (1985–2024)

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Key Takeaways

- The 20 best-performing U.S. stocks from 1985 to 2024 saw a 72% average drawdown, and took 4.8 years to recover

- The S&P 500 index fell 55% from peak to trough, and recovered in 4.2 years

Investors are often drawn to the attractive returns of legendary stocks, but even the best investments face large drawdowns when held for the long term.

This chart shows the top 20 publicly traded U.S. companies by annualized total shareholder return between 1985 and 2024, and shows each stock’s maximum drawdown (peak-to-trough decline) and recovery time. The data comes from Morgan Stanley’s Counterpoint Global Insights.

The Volatility Behind Long-Term Returns

On average, the top 20 best-performing U.S. stocks delivered an annualized return of 19.3% over the 40-year period, beating the S&P 500’s 11.8%. However, nearly all of them suffered losses of 55% or more from peak to trough at some point, and some took nearly a decade to recover.

Here’s a look at the drawdowns and recovery timelines of America’s top-performing stocks from 1985 to 2024:

| Company | Annualized Total Shareholder Return (1985-2024) | Max Drawdown | Recovery time (years) |

|---|---|---|---|

| Amgen | 22.7% | -64% | 1.6 |

| Apple | 21.6% | -83% | 1.8 |

| Paychex | 20.8% | -67% | 7.4 |

| Home Depot | 20.5% | -76% | 4.4 |

| Progressive Corporation | 20.4% | -74% | 2.1 |

| Williams-Sonoma | 20.4% | -90% | 2.5 |

| Stryker Corporation | 19.7% | -60% | 4.8 |

| Brown & Brown | 19.7% | -58% | 7.1 |

| Raymond James Financial | 19.6% | -72% | 2.0 |

| HF Sinclair Corporation | 19.4% | -87% | 3.7 |

| NIKE | 19.0% | -66% | 4.0 |

| Applied Materials | 19.0% | -86% | 9.0 |

| Graco | 18.9% | -72% | 2.1 |

| Badger Meter | 18.8% | -72% | 6.5 |

| Expeditors International | 18.7% | -59% | 8.4 |

| Cintas Corporation | 17.9% | -68% | 4.7 |

| Gentex Corporation | 17.8% | -72% | 2.1 |

| Sherwin-Williams | 17.2% | -55% | 4.2 |

| Eli Lilly and Company | 17.2% | -75% | 9.6 |

| Aflac Incorporated | 17.0% | -84% | 7.1 |

| S&P 500 | 11.8% | -58% | 4.2 |

Amgen, a biotech firm and the top-performing stock, delivered a 22.7% annualized return from 1985 to 2024. It also saw a sharp 64% fall in just 0.6 years, though it recovered faster than any other stock on the list.

Apple, the second-best performer over the 40 years, dropped 83% during its roughest patch, but went on to post a 123% return in the first year post-drawdown.

Williams-Sonoma, a kitchenware and furniture firm, saw the worst crash of the top 20 stocks, losing 90% of its value during the 2008 Financial Crisis. However, the firm has persevered, delivering a 20.4% annualized return from 1985–2024, with a 371% return in just one year from the bottom.

Eli Lilly and Co. took the longest to recover from its maximum drawdown, taking 9.6 years to return to its peak. Its drawdown lasted 8.7 years from the year 2000 to 2009, the longest of any stock on the list.

On average, the top 20 stocks saw a maximum drawdown of 72%, and took 4.8 years to recover. In comparison, the S&P 500 index fell 55% in its biggest drawdown, and recovered in 4.2 years.

Why Staying Invested Matters

Investors who stay invested often ride through the highs and lows, seeing higher overall appreciation over the long term.

Historical data shows that being fully invested over a 20-year period outperforms attempts to time the market, and missing just a few of the market’s best days can drastically reduce total returns.

Furthermore, long-term holding allows investors to compound their gains, although it can come at the expense of large drawdowns.

Learn More on the Voronoi App ![]()

If you enjoyed this infographic, see The S&P 500’s Yearly Declines and Returns on Voronoi, the new app from Visual Capitalist.