Obama's Legacy: Obamacare Failure, Drone Policy Failure, Guantanamo Failure, NSA Spying Failure

Submitted by Mike Shedlock via MishTalk.com,

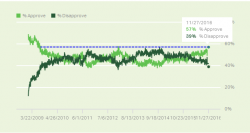

Gallup’s Daily Obama Approval Rating poll shows Americans view president Obama consistently higher now than at any time since 2009.

His popularity is more of a reflection on Obama being a likable person, than having likable policies. It’s also a reflection on the extreme unpopularity of both Hillary Clinton and Donald Trump.

Complete Failure

Likable or not, Obama’s legacy will be one of complete failure. Vox reports The whole Democratic Party is now a smoking pile of rubble.