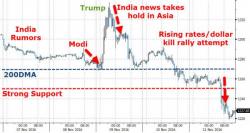

Is This The Reason Why Gold Prices Are Plunging?

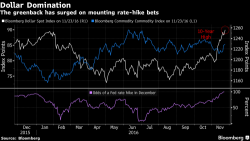

While the optics of a soaring stock market and crashing safe-havens (gold and bonds) fits nicely with the election of Donald Trump as the next US president, a closer look shows gold prices beginning to break hours earlier. As India unleashed its demonetization scheme, local retail gold prices began to surge as rumors began to spread of an Indian gold import ban. As rumors have continued, precious metals prices have plunged as the 700 tons of gold imports to India would be a major demand shock for the bullion market.