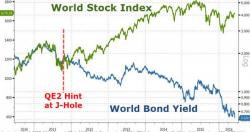

Developed World Bond Yields Plunge To Record Lows

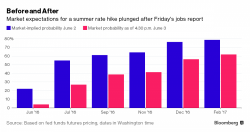

With the plunge in rate-hike odds and fears over Brexit, it appears the safety of global developed market bonds is sought after as Bloomberg's Developed World Bond yield slumps to just 62bps - a record low. Yields are moving opposite to what economist expected (and have been expecting since the fall of 2011 when Ben Bernanke broke the capital markets).

Record low global bond yields...