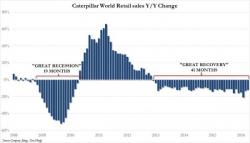

Caterpillar Retail Sales Fall For Record 41 Consecutive Months

For Caterpillar, the great recession was bad, for about 19 months. In May 2010, after declining sharply for just under two years, CAT posted it first positive global retail sales comps and never looked back... until December 2012 when comp sales once again turned negative and have been negative ever since. For the past 41 months!

The breakdown showed that contrary to popular opinion, there has been no pick up in demand for heavy industrial machinery anywhere around the globe.