The S&P 500 Chart Shows A "December Swoon" Is Straight Ahead

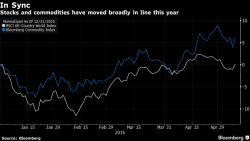

With the recent rally showing increasing signs of exhaustion and the market topping, traders have begun to wonder if the S&P500 will suffer the same fate in the coming months as it did in August 2015, and - more apropos - in December, when the S&P failed to make a new high before starting a more significant correction leg into January.