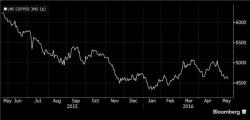

Copper Slides To Three Month Low Despite Flat Futures, Oil; Dollar Rise Continues

After two violently volatile days in which the market soared (Monday) then promptly retraced all gains (Tuesday), the overnight session has been relatively calm with futures and oil both unchanged even as the BBG dollar index rose to the highest level since April 4. This took place despite a substantial amount of macro data from both Japan, where the GDP came well above the expected 0.3%, instead printing 1.7% annualized, which pushed stocks lower as it meant the probability of more BOJ interventions or a delay of the sales tax hike both dropped.