Kuroda To The Rescue: Stocks Rebound After Latest BOJ Rumor Sends Yen Plunging

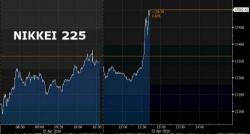

Just as US equity futures were about to roll over following some very substantial misses yesterday by the likes of Google, Microsoft, Starbucks and a plunge in Visa shares, overnight who came to the markets' rescue but the BOJ, when shortly after midnight Bloomberg reported that "according to people familiar with talks at the BOJ" which is the traditional keyword for a BOJ source testing out the market's reaction, Japan's central bank may "help" local banks to lend by offering a negative rate on some loans.